The Fact About Do I Have To List All My Assets and Debts When Filing Bankruptcy? That No One Is Suggesting

Roxanne, Michigan "It absolutely was good to be able to acquire this program on the internet with my partner in our dwelling. We the two realized a fantastic deal and it absolutely was kind of enjoyment far too."

Amourgis & Associates Revealed November 28, 2018 by Amourgis & Associates Superior dilemma. Chapter 7 bankruptcy is intended to lessen personal debt by liquidating assets to repay creditors. The truth is, though, you have some alternatives and exemptions which make sure that you aren’t still left with practically nothing.

But your circumstance won't be dismissed in Chapter seven bankruptcy. The residence you're not permitted to keep or "exempt" beneath the regulation will continue to have being turned above on the trustee assigned for your situation and marketed to pay for your creditors. You can expect to carry on to owe any amount of money not compensated through the bankruptcy.

When filing for bankruptcy in Ohio, the debtor can retain a restricted level of residence, belongings, and cash flow. The most typical is known as the ‘homestead exemption,’ which makes it possible for a debtor to keep her or his primary home. In Ohio, this at this time applies approximately an fairness price of $136,925.

Though this system is authorized, It really is a smart idea to track how you invest the money just in case a trustee inquires. Marketing or working with nonexempt assets to buy an exempt asset may additionally be probable. Nonetheless, some courts advice frown on this follow, so talk to a bankruptcy law firm initially.

Your monetary circumstance is unique; thus, you cannot foundation what happens as part of your case on One more person's bankruptcy practical experience. We realize that you could be nervous about filing bankruptcy for look what i found a range of factors.

Chapter seven will erase personalized liability within the Take note, nonetheless it won’t do away with the lien. page Which means In case you are at the rear of with your mortgage loan payments, your lender can foreclose on the residence.

We’ve located several matches in your town. You should inform us how they can get in touch to get a consultation. There was a difficulty Using the submission. Make sure you refresh the page and take a look at all over again

You can not discharge those debts in subsequent bankruptcies. The obligations listed in any bankruptcy where by your discharge was denied or revoked for hiding assets cannot be discharged in a very subsequent bankruptcy filing.

Filing bankruptcy also prevents creditors and collectors from contacting you or getting any extra motion when they know you have submitted for bankruptcy. It stops almost everything swiftly.

Microsoft and DuckDuckGo have partnered to provide a research Alternative that delivers suitable advertisements for you when guarding your privacy. In case you click on a Microsoft-provided advertisement, you will be redirected on the advertiser’s landing page by means of Microsoft Promotion’s System.

Meanwhile, When you are my sources filing for Chapter thirteen bankruptcy and strategy to help keep the house, your repayment options could glimpse a bit diverse. Considering the fact that this chapter enables you to reconfigure your debts into a payment program, your previous HOA costs really should be A part of your every month installment.

Dwelling equity loans Home equity financial loans he has a good point Allow you to borrow a lump sum at a hard and fast charge, based on the amount of of the house you very own outright.

If it wasn't to your friends and family supporting you, you could possibly have lost everything. Bankruptcy legislation doesn't Enable you pick and choose the debts you should contain in your bankruptcy situation. It's essential to contain your whole debts within your bankruptcy.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Ariana Richards Then & Now!

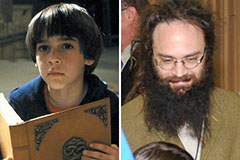

Ariana Richards Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!